Agriculture is one of the most essential sectors in Pakistan. This sector provides food, employment, and income to millions of people. However, a big question is whether farmers and landowners should pay taxes on their agricultural income. Many people are confused about how agriculture tax works in Pakistan. This article will explain the basics of agriculture tax in simple words.

What is Agriculture Tax?

The money collected from farming activities is subject to the agriculture tax. This covers the money from using agricultural land, growing crops, and keeping animals. Pakistan's system differs from that of many other nations in that farming is taxed equally to other industries.

Is Agricultural Income Taxed in Pakistan?

Agriculture earnings are not paid for in taxes by Pakistan's federal government. However, each province (Punjab, Sindh, Khyber Pakhtunkhwa, and Balochistan) has its own set of regulations governing the taxes on agricultural income. This means farmers and farmers pay taxes to the province.

Who Has to Pay Agriculture Tax?

Not every farmer in Pakistan has to pay agriculture tax. The tax mainly applies to large landowners and wealthy farmers. Small farmers with limited land or low income are usually exempt from this tax.

How is Agriculture Tax Calculated?

Agriculture tax in Pakistan is charged in two ways:

- Based on Land Size (Fixed tax per acre)

- Based on Income (Tax percentage on earnings)

Each province has its own tax rates, which are explained below:

Agriculture Tax in Different Provinces

1. Punjab

Punjab, the largest agricultural province, follows these tax rules:

- Farmers with less than 12.5 acres of land do not pay tax.

- Farmers with 12.5 to 25 acres pay Rs. 300 per acre.

- Farmers with above 25 acres pay Rs. 400 per acre.

- If a farmer earns more than Rs. 400,000 per year, they pay 5% income tax.

- If earnings are above Rs. 1,000,000 per year, the tax is 15%.

2. Sindh

Sindh has slightly different rules:

- Farmers with less than 16 acres are exempt.

- Farmers with 16 to 50 acres pay Rs. 150 per acre.

- Farmers with more than 50 acres pay Rs. 250 per acre.

- If a farmer earns more than Rs. 1,000,000 per year, they pay 5% tax.

- If earnings are above Rs. 2,500,000 per year, the tax is 10%.

3. Khyber Pakhtunkhwa & Balochistan

- Farmers pay Rs. 100 to Rs. 250 per acre, depending on the size of the land.

- If their income is above Rs. 400,000, they pay 5% tax.

Why there is no federal tax on agricultural income?

There are many reasons why the federal government does not tax agricultural income:

- Provincial Control: The Constitution of Pakistan gives provinces the power to tax agriculture, not the federal government.

- Farmer Protection: Small farmers struggle with poverty, so taxing them would complicate life.

- Unstable Income: Agriculture income depends on weather conditions, which can be unpredictable.

Problems in the Agriculture Tax System

Despite having tax laws, Pakistan collects very little tax from agriculture. Here’s why:

- Tax Evasion: Many wealthy landlords underreport their income or find ways to avoid tax.

- Fake Agriculture Income: Some people pretend to be farmers and show their business income as agricultural income to escape tax.

- Poor Enforcement: The government does not have an effective system to check and collect agriculture tax properly.

Should Agriculture Be Taxed at the Federal Level?

Many economists believe that big landlords should pay federal tax just like other businesses. If agriculture tax is properly collected, Pakistan can earn billions of rupees in revenue. However, small farmers should still be protected from heavy taxation.

Conclusion

Provincial governments manage agriculture tax in Pakistan. It is not by the federal government. Small farmers are exempt, while large landowners have to pay based on land size or income. However, many wealthy landlords avoid paying their fair share. It is due to loopholes and poor enforcement. Reforming the agriculture tax system can help Pakistan generate more revenue and create a fairer tax structure.

Contact us for:

Office for rent

Office for sale

Agriculture land

House for sale

House for rent

Room for Rent

Flat for Rent

Ideal Farm House

Commercial Avenues

Related posts:

One of Pakistan's most active cities is Faisalabad. It is prominent for its expanding real estate market. It is also growing in business markets, and the textile industry. Every month, a large number of buyers, investors, and business travelers come...

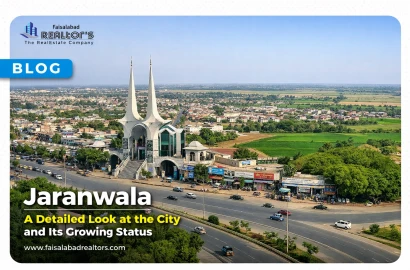

As we know, Jaranwala is a city in Faisalabad District, Punjab, Pakistan. It serves as the headquarters of Jaranwala Tehsil and provides services to a large number of nearby villages. Over the last few decades, the city has grown significantly,...

Faisalabad Best Hotels – A Complete Guide for Comfortable Stay

Faisalabad Best Hotels – A Complete Guide for Comfortable Stay

Turn Your House into a Home Without Breaking the Bank

Turn Your House into a Home Without Breaking the Bank

Jaranwala – A Detailed Look at the City and Its Growing Status

Jaranwala – A Detailed Look at the City and Its Growing Status

Simple & Affordable Home Decor Ideas for Modern Homes in Faisalabad

Simple & Affordable Home Decor Ideas for Modern Homes in Faisalabad

Home Decor Ideas: Smart Ways to Style Your Home without Exceeding Your Budget

Home Decor Ideas: Smart Ways to Style Your Home without Exceeding Your Budget