The Federal Board of Revenue (FBR) recently announced a significant change in property valuation across 56 cities in Pakistan. Starting November 1, 2024, these new values will bring official property rates closer to market rates. It aims to develop a clearer property tax system. This 2024 property update is part of FBR’s efforts to streamline property tax collection across the country.

This FBR update has raised property values in some areas by up to 75% of the current market rate. Many people are asking, "What is the new tax on property in FBR?" and how these new values will affect property transactions? This update will impact property buyers, sellers, and investors, especially in major cities like Karachi, Lahore, Islamabad, and other important areas included in the FBR 56 cities.

Key Highlights of the FBR 2024 Property Update

- Increased Values: What is the latest news about the gain tax on property in Pakistan? Answering the question is property values are now up to 75% of the market rate. This increase is designed to close the gap between declared and actual values.

- Property Categories: New valuations apply to residential, commercial, and industrial properties, setting different rates for each to better reflect market valuation increases.

- Collaboration with Industry: The FBR consulted with developers and builders to make sure these changes addressed real concerns in the real estate market of Pakistan.

- Approved by Law: Under Section 68 (4) of the Income Tax Ordinance, 2001, the FBR set these rates, reviewed by the Law and Justice Division.

How Does This Affect Property Tax?

For those curious about the current property tax in Pakistan, these new values mean that property taxes could go up. By increasing the official property values, the FBR hopes to ensure that the taxes paid by property owners more accurately reflect actual property rates in Pakistan.

The impact is likely to be more noticeable in bigger cities like Karachi, where the property market is already competitive. If you are wondering, "What is the rate of return on property in Pakistan?" the updated rates might influence future returns due to higher transaction values and taxes.

List of Cities with Updated FBR Property Valuation

Below is a table showing the 56 cities affected by the FBR Nov 2024 valuation update:

S.No | City | S.No | City |

1 | Abbottabad | 29 | Mardan |

2 | Attock | 30 | Mirpurkhas |

3 | Bahawalpur | 31 | Multan |

4 | Chakwal | 32 | Nankana |

5 | Dera Ismail Khan | 33 | Narowal |

6 | Dera Ghazi Khan | 34 | Peshawar |

7 | Faisalabad | 35 | Quetta |

8 | Ghotki | 36 | Rahim Yar Khan |

9 | Gujranwala | 37 | Rawalpindi |

10 | Gujrat | 38 | Sahiwal |

11 | Gwadar | 39 | Sargodha |

12 | Hafizabad | 40 | Sheikhupura |

13 | Haripur | 41 | Sialkot |

14 | Hyderabad | 42 | Sukkur |

15 | Islamabad | 43 | Toba Tek Singh |

16 | Jhang | 44 | Karachi |

17 | Jhelum | 45 | Kasur |

18 | Karachi | 46 | Khushab |

19 | Kasur | 47 | Larkana |

20 | Khushab | 48 | Lasbela |

21 | Lahore | 49 | Lodhran |

22 | Larkana | 50 | Mandi Bahauddin |

23 | Lasbela | 51 | Mansehra |

24 | Lodhran | 52 | Hyderabad |

25 | Mandi Bahauddin | 53 | Islamabad |

26 | Mansehra | 54 | Lahore |

27 | Sialkot | 55 | Rawalpindi |

28 | Quetta | 56 | Faisalabad |

Why Does This FBR update of 2024 matter?

The FBR’s property tax update aims to improve clarity in the real estate sector of Pakistan. By setting property values that are closer to market rates, the government can ensure that everyone pays their right share in property taxes. This change will impact anyone buying, selling, or investing in property, especially in cities with high real estate activity like Karachi. It’s a step towards making property dealings in Pakistan more open and trustworthy.

Conclusion

This FBR property valuation update for 56 cities is one of the largest changes in recent years. Property values for residential, commercial, and industrial areas have been raised significantly, affecting property taxes and potentially property returns. If you are involved in real estate or planning to buy or sell property, staying informed on these property rates in Pakistan will help you make better decisions.

This major property tax update from the FBR aims to reflect actual market values. It makes property taxes fairer and easier. Consult a real estate professional to understand how these changes may affect your property transactions.

If you're interested in any property sale or purchase, do contact us. We are the best estate office in Faisalabad.

Contact us for:

House for sale

House for rent

Room for Rent

Flat for Rent

Ideal Farm House

Commercial Avenues

Related posts:

One of Pakistan's most active cities is Faisalabad. It is prominent for its expanding real estate market. It is also growing in business markets, and the textile industry. Every month, a large number of buyers, investors, and business travelers come...

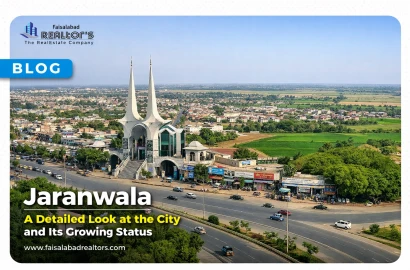

As we know, Jaranwala is a city in Faisalabad District, Punjab, Pakistan. It serves as the headquarters of Jaranwala Tehsil and provides services to a large number of nearby villages. Over the last few decades, the city has grown significantly,...

Faisalabad Best Hotels – A Complete Guide for Comfortable Stay

Faisalabad Best Hotels – A Complete Guide for Comfortable Stay

Turn Your House into a Home Without Breaking the Bank

Turn Your House into a Home Without Breaking the Bank

Jaranwala – A Detailed Look at the City and Its Growing Status

Jaranwala – A Detailed Look at the City and Its Growing Status

Simple & Affordable Home Decor Ideas for Modern Homes in Faisalabad

Simple & Affordable Home Decor Ideas for Modern Homes in Faisalabad

Home Decor Ideas: Smart Ways to Style Your Home without Exceeding Your Budget

Home Decor Ideas: Smart Ways to Style Your Home without Exceeding Your Budget