The Federal Board of Revenue (FBR) recently announced that property values in 56 cities in Pakistan have changed. After November 1, 2024, these new rates will be applied to make property rates more in line with the worth on the market. It will be easy for the government to receive real taxes on sales and purchases of property after this change.

The FBR has increased property values five times since 2018. We can see changes in 2018, 2019, 2021, and 2022, but no changes in the previous two years. This change affects to everyone who buys, sells, or invests in real estate.

Key Points of the New FBR Property Values

- Up to 75% Increase: In some cities, property values are now set at 75% of market rates.

- Different Types of Properties: The new values include separate rates for residential (homes), commercial (businesses), and industrial (factories) properties.

- Industry Input: FBR worked closely with builders and developers to understand their views and make the right changes.

- Legal Approval: These values were also reviewed by the Law and Justice Division to ensure they follow the law.

What is the latest news about the gain tax on property in Pakistan?

The FBR’s goal with these changes in property rates is to make the property market more clear. By setting property values closer to real market prices, it becomes harder to under-report property prices, which can help the government collect taxes more fairly. For buyers, sellers, and investors, these new values might impact the costs and taxes related to property transactions.

Table of Affected Cities

Here’s a list of the 56 cities where property values have been adjusted:

S.No | City | S.No | City |

1 | Abbottabad | 29 | Mardan |

2 | Attock | 30 | Mirpurkhas |

3 | Bahawalpur | 31 | Multan |

4 | Chakwal | 32 | Nankana |

5 | Dera Ismail Khan | 33 | Narowal |

6 | Dera Ghazi Khan | 34 | Peshawar |

7 | Faisalabad | 35 | Quetta |

8 | Ghotki | 36 | Rahim Yar Khan |

9 | Gujranwala | 37 | Rawalpindi |

10 | Gujrat | 38 | Sahiwal |

11 | Gwadar | 39 | Sargodha |

12 | Hafizabad | 40 | Sheikhupura |

13 | Haripur | 41 | Sialkot |

14 | Hyderabad | 42 | Sukkur |

15 | Islamabad | 43 | Toba Tek Singh |

16 | Jhang | 44 | Karachi |

17 | Jhelum | 45 | Kasur |

18 | Karachi | 46 | Khushab |

19 | Kasur | 47 | Larkana |

20 | Khushab | 48 | Lasbela |

21 | Lahore | 49 | Lodhran |

22 | Larkana | 50 | Mandi Bahauddin |

23 | Lasbela | 51 | Mansehra |

24 | Lodhran | 52 | Hyderabad |

25 | Mandi Bahauddin | 53 | Islamabad |

26 | Mansehra | 54 | Lahore |

27 | Sialkot | 55 | Rawalpindi |

28 | Quetta | 56 | Faisalabad |

FBR Email Address

For property-related issues, tax concerns, or questions about gain tax on property, FBR property value, or rental income tax, please contact FBR directly via their official email address. Reaching out via email helps you to obtain official responses and clarifications on tax regulations, rates, and procedures.

To contact the FBR, please send an email to helpline@fbr.gov.pk. In your message, please provide:

Provide your entire name and contact details.

A precise description of your query (for example, "FBR gain tax on property" or "FBR rent calculator assistance").

Any relevant papers or information linked to your inquiry. You can also contact the FBR helpline at 051-111-772-772 for instant assistance.

Conclusion

The FBR’s decision to raise property values in 56 cities is a step towards making property taxes fairer. These changes will help bring official property prices closer to market rates, encouraging honest reporting in the property market. Buyers, sellers, and investors should stay updated and consult real estate experts to understand how this may impact their property plans and costs.

If you're interested in any property sale or purchase, do contact us. We are the best estate office in Faisalabad.

Contact us for:

House for sale

House for rent

Room for Rent

Flat for Rent

Ideal Farm House

Commercial Avenues

Related posts:

One of Pakistan's most active cities is Faisalabad. It is prominent for its expanding real estate market. It is also growing in business markets, and the textile industry. Every month, a large number of buyers, investors, and business travelers come...

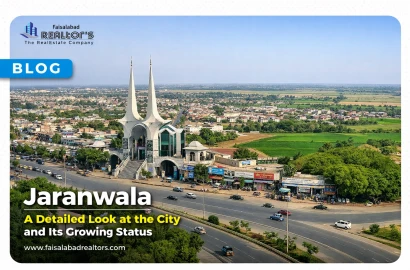

As we know, Jaranwala is a city in Faisalabad District, Punjab, Pakistan. It serves as the headquarters of Jaranwala Tehsil and provides services to a large number of nearby villages. Over the last few decades, the city has grown significantly,...

Faisalabad Best Hotels – A Complete Guide for Comfortable Stay

Faisalabad Best Hotels – A Complete Guide for Comfortable Stay

Turn Your House into a Home Without Breaking the Bank

Turn Your House into a Home Without Breaking the Bank

Jaranwala – A Detailed Look at the City and Its Growing Status

Jaranwala – A Detailed Look at the City and Its Growing Status

Simple & Affordable Home Decor Ideas for Modern Homes in Faisalabad

Simple & Affordable Home Decor Ideas for Modern Homes in Faisalabad

Home Decor Ideas: Smart Ways to Style Your Home without Exceeding Your Budget

Home Decor Ideas: Smart Ways to Style Your Home without Exceeding Your Budget