Investing in farmland has long been a popular way to grow and keep wealth. As the world's population increases and more food is needed, farmland remains crucial. However, like any investment, buying farmland has potential benefits and risks. In this article by Faisalabad Realtors , we will cover all the main points to consider when deciding if investing in farmland is right for you.

Why Do People Invest in Agricultural Land?

Investing in agricultural land is becoming increasingly popular for several compelling reasons. Here's a detailed explanation, broken down into simple terms:

Stable Investment

Agricultural land is considered a stable investment. Over the years, the value of farmland has steadily increased. This is primarily because the demand for food and farming products always remains. As the global population grows, the need for food rises, ensuring that farmland remains valuable.

Protection Against Inflation

Agricultural land offers a safeguard against inflation. Inflation is when the cost of living increases over time, reducing the purchasing power of money. However, as inflation drives up the prices of goods and services, the value of agricultural products also increases. Consequently, the worth of agricultural land tends to rise alongside inflation, preserving your investment's value.

Income Generation

Owning agricultural land can be a source of regular income. Here's how you can earn from it:

- Growing Crops: Planting and harvesting crops can generate revenue from the sale of these goods.

- Raising Livestock: Farming animals like cattle, sheep, or poultry can be profitable, as you can sell meat, dairy, or eggs.

- Renting Out Land: If you prefer not to farm the land yourself, you can lease it to other farmers. The rent payments provide you with a consistent income stream.

Diversification

Investing in agricultural land helps diversify your investment portfolio. Diversification means spreading out your investments to reduce risk. Farmland doesn't move in the same way as the stock market. If the stock market value is represented poorly, your farmland's value might still hold steady or even increase. This can help balance your overall financial risk, providing more security during economic downturns.

Positive Impact

Investing in agricultural land can also have positive social and environmental effects:

- Sustainable Farming: By practicing sustainable farming methods, you can help maintain soil health, conserve water, and reduce the use of harmful chemicals.

- Supporting Biodiversity: Sustainable farming supports a variety of plants and animals, promoting a healthier ecosystem.

- Fighting Climate Change: Sustainable agricultural practices can help reduce greenhouse gas emissions and get more carbon sequestration, contributing to the fight against weather change.

In summary, people invest in agricultural land because it is a stable and appreciating asset that can protect against inflation, generate income, diversify investment portfolios, and provide environmental and societal benefits.

Challenges of Investing in Agricultural Land

Market Uncertainty: The agricultural market can be unpredictable due to weather changes, pest problems, and fluctuating prices for crops and Livestock. These issues can affect your profits.

High Costs: Buying and maintaining agricultural land can be expensive. Consider the costs of purchasing the land, building infrastructure, and managing the farm.

Regulations and Policies: Agricultural investments are subject to government rules and policies, which can change and impact your returns. These include land use restrictions and environmental regulations.

Management Challenges: Running a farm requires knowledge and experience. You must understand soil health, crop management, pest control, and market trends. Hiring skilled farm managers can add to your costs.

Liquidity: Selling agricultural land quickly requires work. Finding a buyer and completing the sale can take time and involve high transaction costs.

Important Considerations for Investors

When considering investing in agricultural land, there are several key factors to remember. Here's a detailed and easy-to-understand guide:

Location Matters

The location of the agricultural land plays a vital role in its value and productivity. Here are some things to consider:

- Soil Quality: Good soil is crucial for growing healthy crops. Research the soil's fertility and suitability for different types of crops.

- Climate: The weather conditions in the area, including temperature and rainfall, affect what you can grow and how well it will grow.

- Water Availability: Reliable water access is critical for crops and Livestock. Check if the land has sound irrigation systems or natural water sources.

- Proximity to Markets: Land closer to markets or distribution centers can reduce transportation costs and make it easier to sell your products.

Type of Farming

Decide what kind of farming you want to invest in. Here are the main options:

- Growing Crops: This includes vegetables, fruits, grains, and other plants. Each crop has different needs and market values.

- Raising Livestock involves raising animals like cows, pigs, chickens, and sheep. Livestock farming has different challenges and rewards compared to crop farming.

- Combination: Some investors mix crops and Livestock to balance risks and opportunities.

Sustainable Farming

Using sustainable farming practices can be beneficial for several reasons:

- Long-Term Value: Sustainable methods help maintain the land's health, ensuring it remains productive for many years.

- Consumer Demand: More people are looking for environmentally friendly and organic food, which can increase the marketability and value of your products.

Partnerships and Expertise

Working with experienced professionals can help manage the complexities of farming:

- Experienced Farmers: Partnering with knowledgeable farmers can bring valuable expertise and reduce the risk of operational mistakes.

- Agricultural Managers: Hiring managers who understand the industry can help oversee daily operations and make strategic decisions to improve productivity and profitability.

Financial Planning

Before you invest, it's essential to do a thorough financial analysis:

- Understand Costs: Know all the expenses involved, such as buying the land, equipment, seeds, fertilizers, and labor.

- Estimate Income: Calculate the potential earnings from selling crops or Livestock. Consider different scenarios to understand potential risks and rewards.

- Value Appreciation: Consider how the land's value might increase over time, taking into account factors like improvements you plan to make and general market trends.

Investing in agricultural land requires careful consideration of its location, the type of farming, sustainable practices, the benefits of partnerships and expertise, and thorough financial planning. By paying attention to these factors, you can make a more informed and successful investment.

Conclusion

Investing in agricultural land can be rewarding, providing financial returns and contributing to global food security and environmental health. However, this field comes with challenges and requires careful planning and management. By understanding the benefits and risks and making informed decisions, you can determine if agricultural land is a suitable investment.

If you're interested in any kind of property sale or purchase then do contact us. We are the best estate office in Faisalabad.

Contact us for:

House for sale

House for rent

Room for Rent

Flat for Rent

Ideal Farm House

Commercial Avenues

Related posts:

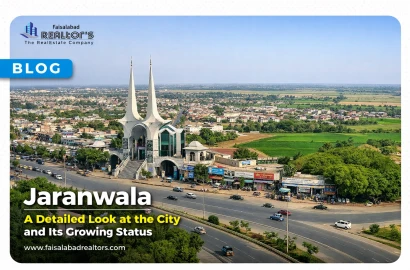

As we know, Jaranwala is a city in Faisalabad District, Punjab, Pakistan. It serves as the headquarters of Jaranwala Tehsil and provides services to a large number of nearby villages. Over the last few decades, the city has grown significantly,...

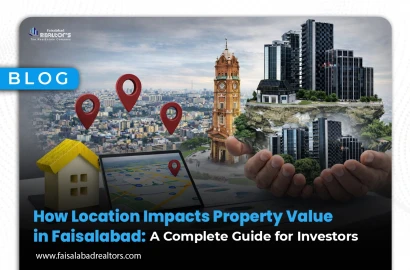

The traditional adage "location, location, location" is more than a mere slogan when it comes to real estate; it's the most important aspect that affects property value by location. The area in which a property is located can have a...

Turn Your House into a Home Without Breaking the Bank

Turn Your House into a Home Without Breaking the Bank

Jaranwala – A Detailed Look at the City and Its Growing Status

Jaranwala – A Detailed Look at the City and Its Growing Status

Simple & Affordable Home Decor Ideas for Modern Homes in Faisalabad

Simple & Affordable Home Decor Ideas for Modern Homes in Faisalabad

Home Decor Ideas: Smart Ways to Style Your Home without Exceeding Your Budget

Home Decor Ideas: Smart Ways to Style Your Home without Exceeding Your Budget

How Location Impacts Property Value in Faisalabad: A Complete Guide for Investors

How Location Impacts Property Value in Faisalabad: A Complete Guide for Investors