Investing in the real estate market in pakistan is the best way to earn a good profit. We know that the real estate market is making progress very fast in pakistan. This sector provides commercial and residential property to investors. There are two options for investors to invest in real estate. These are real estate investment trusts (REITs) and direct property investment ownership. Both these options have its own rules for investors to invest. So this highly depends on investors' financial condition and resources. In this article, we will discuss which option is best for investors and its advantages and challenges in the real estate sector. So stay connected with us:

Real Estate Investment Trusts(RIETs):

We know that Real Estate Investment Trust (REIT) is a company that holds and operates real estate income. By investing in this company, we know we buy shares in real estate property, such as commercial buildings, residential property, or shopping centers. This company trades for stock exchanges, making them easy to buy and sell. In Pakistan, REITs are still a developing concept. Also, they have a good image as a more accessible way for investors to enter the real estate market. So it is the best way to invest money in Pakistan.

Advantages of REITs

Accessibility and Liquidity

We can say that one of the biggest benefits of a REIT Pakistan company is the easy way of entry and exit. We know that this company also trades on stock exchanges and we can quickly buy or sell shares without any long process. The investors do not need to physically work with this company. This makes REITs more special, giving you great flexibility to manage your investments.

Start with a small investment in pakistan

We know that this company gives a benefit to investors in real estate to invest with a small amount of money. Instead of the large amount of payment required for direct property ownership, you can purchase REIT Pakistan shares with an amount suitable to your budget. It is making real estate investment more accessible for investors with limited funds and small investments in pakistan.

No Property Management problems

We can say with REITs, you do not need to worry about maintaining a property. Like handling renter issues, or managing repairs and renovations. The REIT company takes care of all property management, allowing you to benefit from real estate investments without the responsibilities and stress of direct ownership.

Disadvantages of REITs

Limited Control

When investors invest in this company they do not have a personal choice in property management decisions. Because investors rely on the REIT Pakistan company’s expertise, you have no right to give an opinion on property renovations, tenant selection, or sale timing.

Market changes

We know that REITs do trading publicly and their prices can change with the stock market, which may not always match with the real value of the properties. This means that REITs can be affected by big market trends and badly impact their value even if the properties are stable.

Management Fees

There are some management fees that investors pay to this company. These fees cover the cost of managing the properties, which means you might earn slightly less than if you directly owned the property.

Direct Property Ownership

We know that Direct Property Ownership means buying a physical property. Like a home, apartment, or commercial space and take ownership at the time. This option provides more control for the property and returns high profits. But it also requires a significant commitment of time, money, and effort. So direct ownership is not a bad option.

Advantages of Direct Property Ownership

Control and Decision-Making

We know that when investors directly buy ownership, they have the right to make all decisions about it, from managing tenants to choosing renovation projects. This level of control allows you to actively increase your property’s value or rental income. And giving you more profit on your investment.

Source of monthly income

We know Owning a rental property allows you to earn regular income through rent. This monthly cash flow provides financial stability. We also know that as property values rise, the rental income can also increase with time.

Tax Benefits in Pakistan

We know that Real estate ownership offers tax advantages. Like depreciation deductions, mortgage interest deductions, and capital gains exemptions. In Pakistan, capital gain tax on the sale of property in Pakistan is reduced after a few years of holding, which means long-term investors may benefit from lower taxes on profits. For example, after holding a property for six years, the tax is majorly reduced.

Disadvantages of Direct Property Ownership

High Initial Investment

We know that direct ownership of a property needs a large amount of money. This payment is used in different conditions like down payment, closing costs, and renovations of the building. For many people, the financial problems can be challenging to overcome.

Property Management Responsibility

As a property owner responsible for managing the property, handling tenant issues, and also covering maintenance costs. This can be time-consuming and stressful, particularly if you doing multiple properties.

Less Liquidity

We know well that Real estate is not easy to buy or sell as REITs. Selling a property can take weeks or even months, making it a less liquid investment. If you need quick cash, it is very difficult to access funds and add in a property.

Capital Gain Tax on Sale of Property in Pakistan

In Pakistan, the Capital Gains Tax (CGT) on property sales changes based on the holding period. If you sell a property within the first year of purchase, the tax rate is generally high. If you hold the property for more than four years, the tax rate decreases, and after six years, there may be no tax on it. This makes real estate an attractive option for long-term investment, as you can benefit from paying lower taxes on profits.

Conclusion

In last, we will only say every decision highly depends on the investor's budget and schedule of daily life routine. In this article, we discuss the differences between direct property ownership and real estate investment trust in detail. Also the advantages and disadvantages of these categories. We know that every real estate trend has its marketing. So investors make a wise decision to attain great profit on their investment. So it highly depends on the investor's mindset which one way he/she chooses for future settlement.

If you're interested in any property sale or purchase, do contact us. We are the best estate office in Faisalabad.

Contact us for:

House for sale

House for rent

Room for Rent

Flat for Rent

Ideal Farm House

Commercial Avenues

Related posts:

One of Pakistan's most active cities is Faisalabad. It is prominent for its expanding real estate market. It is also growing in business markets, and the textile industry. Every month, a large number of buyers, investors, and business travelers come...

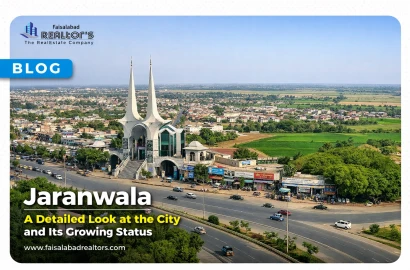

As we know, Jaranwala is a city in Faisalabad District, Punjab, Pakistan. It serves as the headquarters of Jaranwala Tehsil and provides services to a large number of nearby villages. Over the last few decades, the city has grown significantly,...

Faisalabad Best Hotels – A Complete Guide for Comfortable Stay

Faisalabad Best Hotels – A Complete Guide for Comfortable Stay

Turn Your House into a Home Without Breaking the Bank

Turn Your House into a Home Without Breaking the Bank

Jaranwala – A Detailed Look at the City and Its Growing Status

Jaranwala – A Detailed Look at the City and Its Growing Status

Simple & Affordable Home Decor Ideas for Modern Homes in Faisalabad

Simple & Affordable Home Decor Ideas for Modern Homes in Faisalabad

Home Decor Ideas: Smart Ways to Style Your Home without Exceeding Your Budget

Home Decor Ideas: Smart Ways to Style Your Home without Exceeding Your Budget